Answer the following statements true (T) or false (F)

1. The receipt of boot as part of a nontaxable exchange causes a realized loss to be recognized.

2. Where non-like-kind property other than cash is received as boot, the amount of the boot is the property's fair market value.

3. If each party in a like-kind exchange assumes a liability of the other party, only the net liability given or received is boot.

4. A taxpayer conducts a qualifying like-kind exchange. There is no boot involved in the transaction. The basis of the property received will equal the adjusted basis of the property exchanged.

5. The basis of non-like-kind property received is the basis in the hands of the transferor at the date of the exchange.

1. FALSE

Receipt of boot will only cause recognition if gain is realized on the underlying exchange.

2. TRUE

If non-like-kind property other than cash is received as boot, the amount of the boot is the property's fair market value.

3. TRUE

The exchange of liabilities is netted to determine which party is deemed to have received boot and which party is deemed to have paid boot.

4. TRUE

No gain or loss will be recognized, and no boot is received. As a result, the basis of the property received will equal the adjusted basis of the property exchanged.

5. FALSE

Boot is received at fair market value.

You might also like to view...

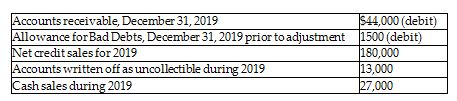

The following information is from the 2019 records of Uptown Antique Shop:

Bad debts expense is estimated by the percent-of-sales method. Management estimates that 4% of net credit sales will be uncollectible. The ending balance of the Allowance for Bad Debts account after adjustment will be ________.

A) $8700

B) $6780

C) $9780

D) $5700

Sentences should generally NOT end with a preposition

Indicate whether the statement is true or false

Increased collection expenditures should reduce the investment in accounts receivable and bad debt expenses, increasing profits

Indicate whether the statement is true or false

Which of the following is a legal protection associated with registering a trademark:

a. state payment of court fees associated with suing for infringement b. legal assistance by Trademark Office in case of challenge to mark c. federal court jurisdiction, if desired d. all of the other specific choices are correct e. none of the other specific choices are correct