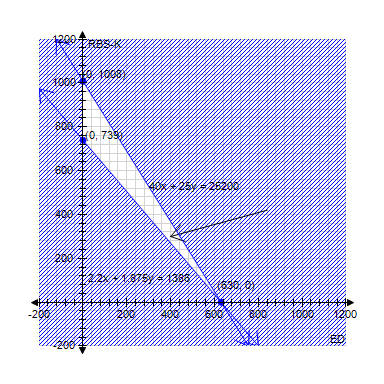

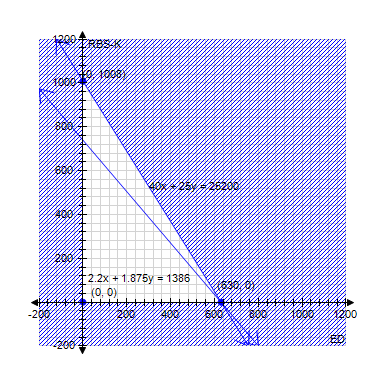

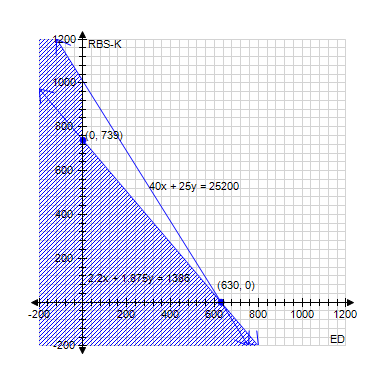

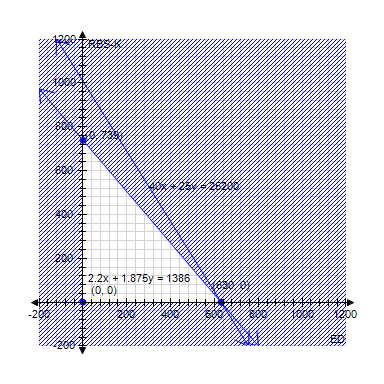

Your friend's portfolio manager has suggested two high-yielding stocks: Consolidated Edison (ED) and Royal Bank of Scotland (RBS-K). ED shares cost $40 and yield 5.5% in dividends. RBS-K shares cost $25 and yield 7.5% in dividends. You have up to $25,200 to invest, and would like to earn at least $1,386 in dividends. Draw the feasible region that shows how many shares in each company you can buy. Find the corner points of the region. (Round each coordinate to the nearest whole number.)

?

Let the number of shares in ED be x, and the number of shares in RBS-K be y.

?

A. ?

B. ?

?

C. ?

?

D. ?

?

E. ?

?

Answer: A

Mathematics

You might also like to view...

Find the accumulated amount after 6 year(s) if $5,000 is invested at 8% compounded continuously. Round your answer to the nearest cent. ? $__________

Fill in the blank(s) with the appropriate word(s).

Mathematics

?

Mathematics

Decide whether the composite functions, f ? g and g ? f, are equal to x.f(x) =  , g(x) = x

, g(x) = x

A. No, yes B. Yes, no C. Yes, yes D. No, no

Mathematics

Provide an appropriate response.Evaluate dy and ?y for y = f(x) = x2 -7x + 5, x = 7, and dx = ?x = 0.5.

A. dy = 3.5; ?y = 3.75 B. dy = 3.75; ?y = 3.5 C. dy = 3.75; ?y = 3.75 D. dy = 3.5; ?y = 3.5

Mathematics