If one borrower fails to repay a loan,

a. most banks will have serious problems.

b. a bank will attempt to sell the loan.

c. it will not affect a diversified bank

d. the bank will report this to the borrower's employer.

c

You might also like to view...

Consider the budget line in the above figure. If the consumer has income of $240, what is the relative price of movies?

A) .42 books B) 2.4 books C) $10 per movie D) $24 per movie

From 2004 to 2006 the Fed raised the federal funds rate gradually in a series of steps. The Fed's purpose was to raise the prime interest rate so that:

A. high inflation rates would fall. B. aggregate demand would continue to grow consistently and with low inflation. C. aggregate supply would grow, increasing output and lowering the price level. D. banks would reduce lending that was building up unmanageable consumer debt.

If goods A and B are considered substitutes, an increase in the price of A would cause

A. the demand curve for B to shift to the left. B. a movement along the demand curve for B to a (lower price, higher quantity) point. C. the demand curve for B to shift to the right. D. a movement along the demand curve for B to a (higher price, lower quantity) point.

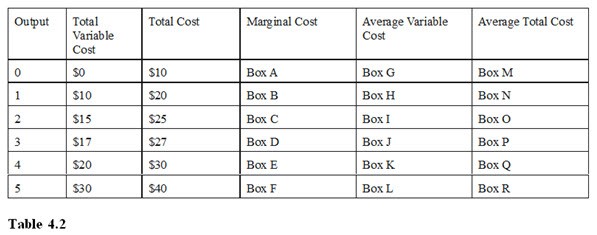

Referring to Table 4.2, Box B should be filled with

A. $20. B. $0. C. $10. D. $30.