What challenges does the European Central Bank (ECB) face in making monetary policy for the euro zone?

What will be an ideal response?

POSSIBLE RESPONSE: Economic shocks can affect different countries in different ways. Weak demand may cause recessions in some countries while other countries may experience expansion. One common monetary policy may not suit all. There are no automatic stabilizers on the fiscal policy side to shift higher tax revenues from high-growth countries to low-growth countries by way of lower taxes and larger expenditures in the low-growth countries. This creates a problem of inability to address national recessions quickly. In addition, there is still room for politics in the ECB's decisions-national economic interests can sway union-wide policy decisions.

You might also like to view...

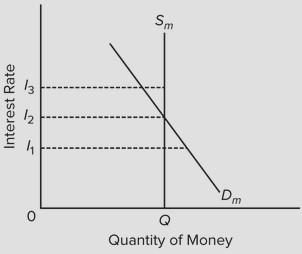

Use the following diagram of the market for money to answer the next question. The downward slope of the money demand curve Dm is best explained in terms of the

The downward slope of the money demand curve Dm is best explained in terms of the

A. asset demand for money. B. wealth or real-balances effect. C. direct or positive relationship between bond prices and interest rates. D. transactions demand for money.

Entry into a monopolistically competitive industry is

a. easy, but exiting is difficult b. difficult, but exiting is easy c. difficult, but not impossible d. impossible e. easier than entry into oligopoly

Graphically, what does the marginal product curve for a labor input look like? Explain in words

What will be an ideal response?

Answer the following questions true (T) or false (F)

1. In the circular flow model, households supply resources such as labor services in the product market. 2. A welding machine is an example of a factor of production if it is being used to produce automobiles. 3. One of the monetary policy goals of the Federal Reserve is price stability.