Taxes and in-kind transfers make the distribution of income more unequal

a. True

b. False

B

You might also like to view...

A corporation's market capitalization is best described as

A) the total value of its stocks and bonds. B) the total value of its common and preferred stock. C) its total profit for a particular year. D) its average profit over a period of years.

Suppose there is currently a surplus of wheat on the world market. The problem of excess supply may be removed from the market by:

A) lowering the market price. B) shifting the supply curve leftward. C) shifting the demand curve leftward. D) Both A and B are plausible actions.

Factors that affect the ability of oligopolistic firms to successfully engage in cooperation include ____

a. number and size distribution of sellers b. size and frequency of orders c. product heterogeneity d. a and b only e. a, b, and c

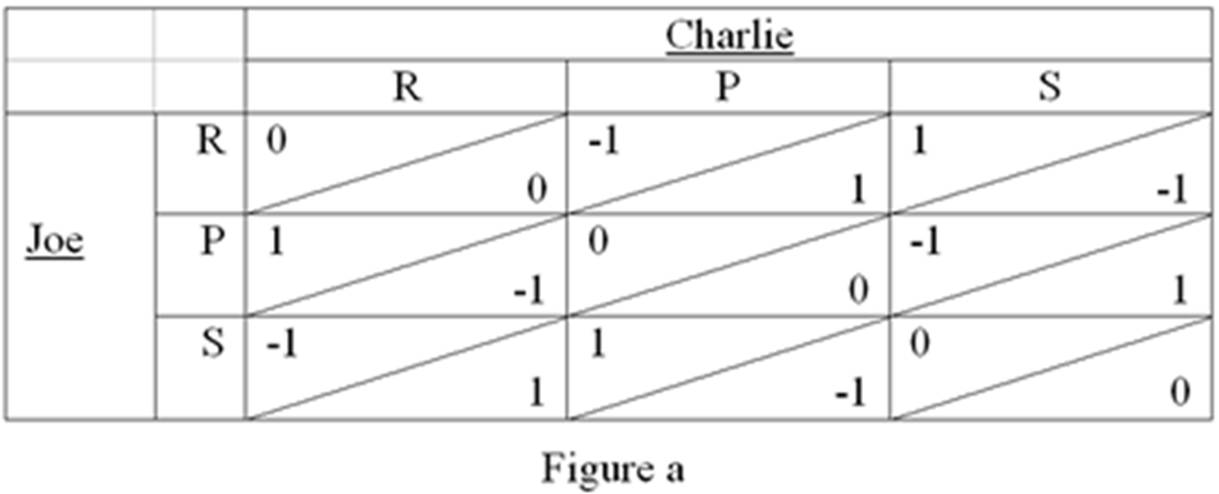

Refer to Figure a. Charlie and Joe both want to ride shotgun with their mother, so they play a game of rock-paper-scissors to determine who gets to sit in the front seat. In the table, -1 represents a loss, 1 a win and 0 a tie, and Joe's payoff is shown in the upper left-hand corner of each cell, while Charlie's appears in the lower right-hand corner. If Joe knows Charlie thinks he always throws scissors, what is Joe's best response?

A. Rock

B. Paper

C. Scissors

D. The answer cannot be determined from the information given.