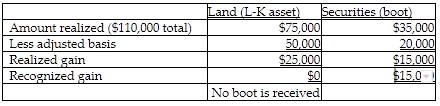

Olivia exchanges land with a $50,000 basis plus marketable securities with a $20,000 basis for a larger parcel of land worth $110,000 in a transaction that otherwise qualifies as a like-kind exchange. The FMV of the land and marketable securities exchanged by Olivia is $75,000 and $35,000 respectively.

a. What is the amount of gain realized and recognized by Olivia on each asset?

b. What is the amount of Olivia's basis in the new land?

a.

b. Olivia's basis in the new land is: $85,000:

$50,000 basis of old land + $20,000 of marketable securities + 15,000 gain recognized, or

$110,000 FMV new land - $25,000 unrecognized gain

You might also like to view...

To control the problems of interviewers not strictly following the sampling plan, supervisors should keep daily records of all of the following EXCEPT:

A) the number of calls made. B) the number of not-at-homes. C) the number of refusals. D) the number of completed interviews for each interviewer. E) supervisors should keep daily records of all of the selections to control interviewers.

The effective-interest method of amortizing a bond discount or premium is the preferred method

Indicate whether the statement is true or false

When a consultant proposes a program to a client, the most suitable report form is a memorandum report

Indicate whether the statement is true or false

Rony is an entrepreneur with a small import–export firm in which everyone reports to him person. Rony’s organization has a ______ structure.

A. adhocracy B. strategic apex C. technostructure D. simple