What happens when the original depreciation or amortization schedule for long-lived assets requires changing?

CHANGES IN SERVICE LIVES OR SALVAGE VALUES

The original depreciation or amortization schedule for long-lived assets sometimes requires changing. Each period a firm must evaluate its estimates of service life and salvage value and assess if these estimates require changing in light of new information. If changing from the old estimates to the new estimates would have a material impact, the firm must change the depreciation or amortization schedule prospectively. That is, the firm makes no adjustment for the past misestimate but spreads the remaining carrying value less the new estimate of salvage value over the new estimate of the remaining service life of the asset.

The reasoning for adjusting current and future depreciation or amortization charges instead of retrospectively revising past charges rests on the nature and role of estimates in accounting. Management's estimates of depreciable lives and salvage values, uncollectible accounts, warranty costs, and similar items use the available information at the time of the estimate. Changes in estimates occur regularly; many of them do not materially affect the financial statements. Requiring the restatement of previously issued financial statements for changes in estimates might confuse users and undermine the credibility of the statements.

You might also like to view...

Suppose the government grants a subsidy to its export firms that permits them to charge lower prices on goods sold abroad. The export revenue of these firms would rise if the foreign demand is

a. elastic in response to the price reduction. b. inelastic in response to the price reduction. c. unit elastic in response to the price reduction. d. weak.

A pretrial motion is made to try and dispose of all or part of a lawsuit prior to trial.

Answer the following statement true (T) or false (F)

All of the following are operating leases except a

a. monthly lease on a building that can be canceled with 90 days' notice. b. ten-year lease on a new building. c. two-year lease on a truck with an option to renew for one more year. d. five-year lease of a computer with an option to buy for a small amount at the end of the lease.

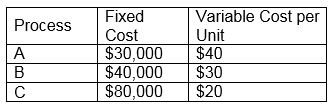

ABC Corporation would like to evaluate three production processes (A, B, and C) to accommodate the changes in demand for its products. The fixed and variable costs per unit are tabled here. Determine the process to be selected when the production volume is 3,000 units.

A. Process A

B. Process B

C. Process C

D. cannot be determined