Which of the following would cause the U.S. money supply to expand?

a. a commercial bank calling in a loan to build up more excess reserves

b. a commercial bank purchasing U.S. securities from the Fed as an investment

c. a decrease in reserve requirements

d. an increase in the discount rate

c

You might also like to view...

If a firm is able to influence its price,

A) it is a monopoly. B) it has constant marginal revenue. C) it sells its output at a constant price. D) it faces a downward-sloping demand curve.

Consumers who are more sensitive to changes in price suffer a greater loss of consumer surplus from any given price increase

Indicate whether the statement is true or false

Financial intermediaries are:

A. institutions that channel funds from people who have them to people who want them. B. government officials who bring together buyers and sellers in a market. C. those who negotiate terms of settlement between borrower and lender when one is in default. D. those who negotiate terms of settlement between buyer and seller when one is in default.

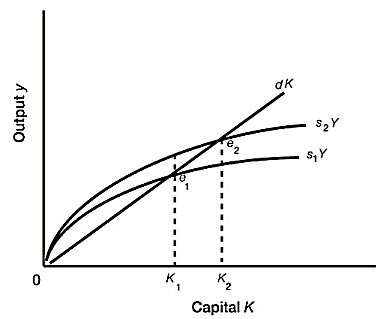

Refer to Figure 13A.2. Compared to curve s1Y, curve s2Y represents:

Refer to Figure 13A.2. Compared to curve s1Y, curve s2Y represents:

A. a decrease in capital deepening. B. a higher saving rate. C. a decrease in depreciation. D. a decrease in original capital stock.