A lump-sum tax, such as a $1000 tax that every family must pay one time, is

A) negatively related to real GDP. B) an autonomous tax.

C) a regressive tax. D) a type of income tax.

B

You might also like to view...

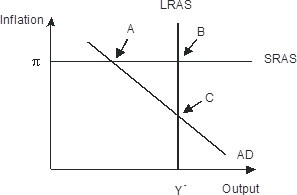

The economy pictured in the figure below has a(n) ________ gap with a short-run equilibrium combination of inflation and output indicated by point ________.

A. recessionary; B B. recessionary; C C. recessionary; A D. expansionary; A

Define and give an example of how a spell of structural unemployment can begin

What will be an ideal response?

Open market purchases ________ reserves and the monetary base thereby ________ the money supply

A) raise; lowering B) raise; raising C) lower; lowering D) lower; raising

Assume that in Canada the opportunity cost of producing one television set is two bushels of wheat. Assume that in the United States the opportunity cost of producing one bushel of wheat is two television sets. If these two countries specialize according to comparative advantage and then trade with each other:

A. the United States will export both televisions and wheat. B. Canada will export both televisions and wheat. C. Canada will export wheat and import televisions. D. the United States will export wheat and import televisions.