How does the Ho-Lee arbitrage-free interest-rate model differ from the Hull-White arbitrage-free interest-rate model?

What will be an ideal response?

Like the Ho-Lee arbitrage-free interest-rate mode, the Hull-White model is a normal model

[i.e., constant elasticity of variance (?) = 0]. However, unlike the Ho-Lee model, the Hull-White model allows for mean reversion. Whereas the Ho-Lee model is the first arbitrage-free model, the Hull-White model is the first arbitrage-free, mean reverting normal model.

You might also like to view...

_____ is a common law writ issued by a superior tribunal to an inferior tribunal or

person requiring that some action be taken. Fill in the blanks with correct word

In order to reduce its current account deficit, the United States must do which of the following?

A) reduce the federal budget deficit B) raise national product relative to national spending C) increase savings relative to domestic investment D) all of the above

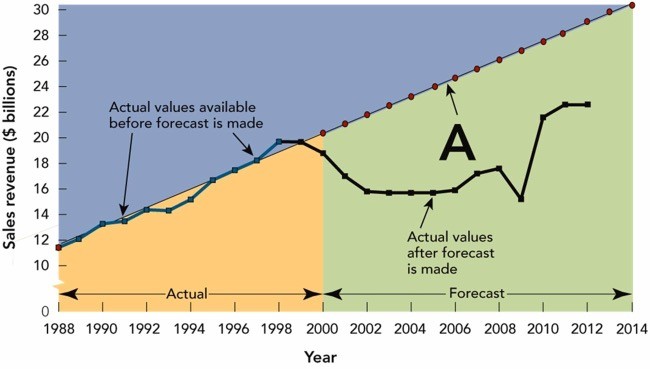

Figure 7-7In Figure 7-7 above, the line identified as A indicates a(n)

Figure 7-7In Figure 7-7 above, the line identified as A indicates a(n)

A. curvilinear extrapolation. B. non-parametric regression. C. causal analysis. D. sales regression. E. linear trend extrapolation forecast.

If assets are $365,000 and equity is $120,000, then liabilities are:

A. $120,000. B. $245,000. C. $610,000. D. $365,000. E. $485,000.