Holten Farm sells new tractors and pays each salesperson a commission of $1,000 for each tractor sold. During the month of August, a salesperson, Fred, sold 3 new tractors. Jacob pays Jason on the 10th day of the month following the sale. Fred operates on the cash basis; the tractor dealer operates on the accrual basis. Which of the following statements is true?

a. Fred will recognize commission revenue earned in the amount of $3,000 in August.

b. Jacob will recognize commission expense in the amount of $3,000 in August.

c. Fred will recognize commission expense in the amount of $3,000 in September.

d. Fred will recognize revenue in the same month that the tractor dealer recognizes expense.

b

You might also like to view...

According to the text, which of the following organizations was recognized as the largest global research firm based on global research revenues?

A) IMS Health Inc. B) Arbitron Inc. C) Nielsen D) Synovate E) GfK SE

Stephanie really does not care if she makes her goal of opening 10 new retail charge accounts during her shift. Stephanie appears to be a problem employee who ______.

A. lacks motivation B. lacks ability C. breaks rules D. has problems

The statute of limitations for an employee to file an EEOC complaint for sexual harassment is: A) 90 days

B) 180 days. C) two years. D) None of the above

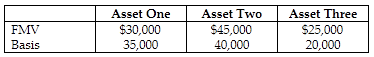

Max's recognized gain is

Max's recognized gain is

A) $3,000.

B) $5,000.

C) $7,000.

D) $10,000.