Recall the Application about how a simultaneous increase in the gasoline tax and decrease in the income tax affect gasoline consumption to answer the following question(s).Recall the Application. Suppose a tax on carbon that increases the price of gasoline is combined with a cut in income taxes to ensure that total tax revenue collected by the government does not change. This tax policy has no ________ but has ________.

A. income effect; a substitution effect.

B. income effect; a positive real effect.

C. no real effect on consumption; an income effect.

D. substitution effect; an income effect.

Answer: A

You might also like to view...

Starting from long-run equilibrium, a large increase in government purchases will result in a(n) ________ gap in the short-run and ________ inflation and ________ output in the long-run.

A. expansionary; higher; potential B. recessionary; higher; potential C. recessionary; lower; lower D. expansionary; higher; higher

Refer to Scenario 14-1. M2 in this simple economy equals

A) $3,000. B) $8,000. C) $14,000. D) $21,000.

If total U.S. trade consists of $10 billion in electronics imports from Japan and $9 billion in automobile exports to Germany, then the U.S. net export account will be negative

a. True b. False Indicate whether the statement is true or false

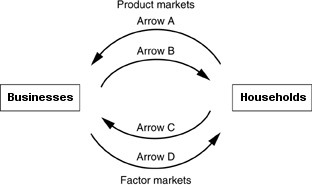

Refer to the above figure. The top two arrows of the figure refer to the product markets. The bottom arrows refer to the factor markets. Which arrow represents factor services?

Refer to the above figure. The top two arrows of the figure refer to the product markets. The bottom arrows refer to the factor markets. Which arrow represents factor services?

A. Arrow A B. Arrow B C. Arrow C D. Arrow D