When income is $15,000, the amount of income taxes owed is $2,000; when income increases to $20,000, the amount owed increases to $3,000. The average income tax rate when a person earns $15,000 is

A) 75 percent.

B) 15 percent.

C) 13.3 percent.

D) 20 percent.

C

You might also like to view...

The FOMC no longer sets targets for M1 and M2 to meet its goals of price stability and high employment

Indicate whether the statement is true or false

The motivation for an individual citizen to spend the necessary time and effort to resist an interest group is minimal, even if she had a guarantee that this resistance would be effective

a. True b. False Indicate whether the statement is true or false

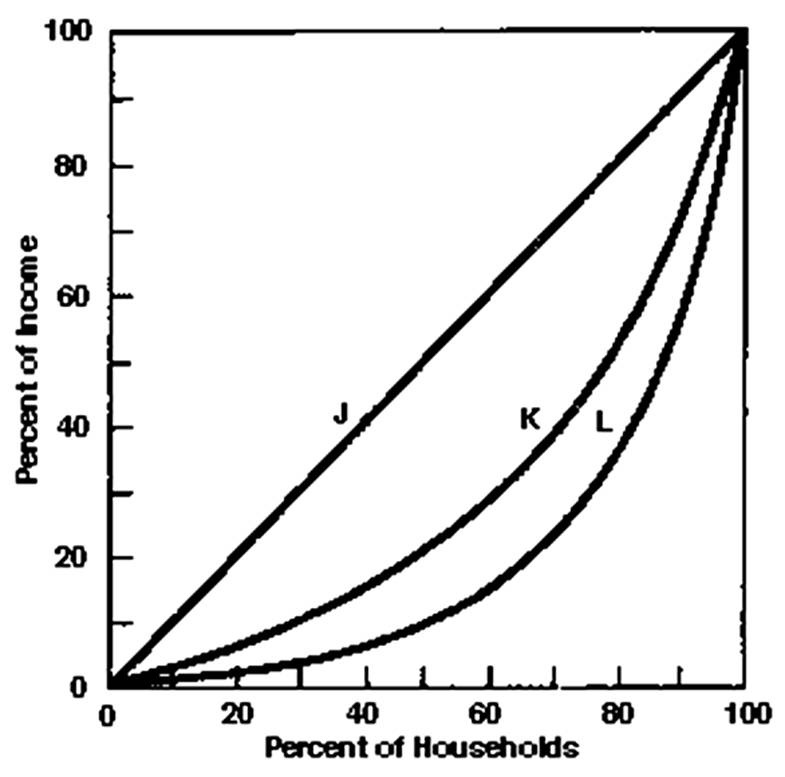

What is the percentage of income received by the lower three quintiles on line K?

If purchasing-power parity holds, when a country's central bank increases the money supply, its

a. price level rises and its currency appreciates relative to other currencies in the world. b. price level rises and its currency depreciates relative to other currencies in the world. c. price level falls and its currency appreciates relative to other currencies in the world. d. price level falls and its currency depreciates relative to other currencies in the world.