Jennifer took out a fixed-interest-rate loan when the CPI was 100 . She expected the CPI to increase to 103 but it actually increased to 105 . The real interest rate she paid is

a. higher than she had expected, and the real value of the loan is higher than she had expected.

b. higher than she had expected, and the real value of the loan is lower than she had expected.

c. lower than she had expected, and the real value of the loan is higher than she had expected.

d. lower then she had expected, and the real value of the loan is lower than she had expected.

d

You might also like to view...

A key assumption of most economic analysis is that people are altruistic, meaning that they act in their own self-interest

Indicate whether the statement is true or false

Refer to Figure 9-2. The increase in domestic producer surplus as a result of the tariff is equal to the area

A) C + D + G + H + I. B) C + G. C) C. D) A + C + G.

A virtue of income taxes over sales taxes is that _____

a. they are more comprehensive b. they are more difficult to avoid c. the excess burden of an income tax system is far smaller d. progression can be built into the system

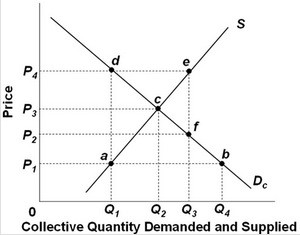

Refer to the above supply and demand graph for a public good. Which one of the following statements is correct?

Refer to the above supply and demand graph for a public good. Which one of the following statements is correct?

A. There will be an overallocation of resources at output level Q1. B. The supply curve reflects the marginal cost and the demand curve reflects the marginal benefit of this public good. C. There will be an underallocation of resources at output level Q3. D. The demand curve reflects the marginal cost and the supply curve reflects the marginal benefit of this public good.