What is a corporate bond and what does it specify?

What will be an ideal response?

A bond is a promise to repay a fixed amount of funds with the coupon rate, the face value of the bond, and the maturity period specified.

You might also like to view...

A principle is a self-evident truth that most people readily understand and accept

Indicate whether the statement is true or false

Currently. the price of consuming housing src="https://sciemce.com/media/3/ppg__cognero__Chapter_06_Doing_the_quot_Best_quot_We_Can__media__3e7add47-491f-48be-8fcb-fd865a8ddf80.PNG" style="vertical-align: -8px;" width="17px" height="28px" align="absmiddle" />. At the same time, the government lowers the tax on other consumption, lowering the price from

a. Write down your original budget constraint assuming the consumer has income I.

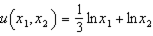

b. Suppose the utility function

c. How much housing and other goods will this consumer consume prior to any policy change?

d. When the policy change goes into effect, will this consumer still be able to afford the bundle you derived in (c)?

e. When the policy change goes into effect, what bundle will the consumer consume?

What will be an ideal response?

Suppose the mean earnings of two groups differ. Which of the following would be the logical conclusion?

a. The group with the lowest earnings must be the victim of employment discrimination. b. The group with the lowest earnings must be less productive. c. The group with the highest earnings is more highly motivated and materialistic. d. Without consideration of preferences and productivity factors, differences in unadjusted mean earnings do not necessarily reflect employment discrimination.

In a well-functioning financial market, the only way to get consistently higher returns over the long run is to take more risks. This is known as the

A. risk-return principle. B. fixed income principle. C. price appreciation principle. D. diversification principle.