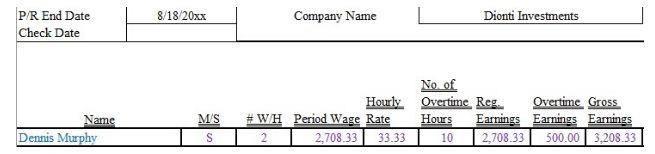

Dennis Murphy is a salaried, nonexempt administrative assistant for Dionti Investments and is paid semimonthly. He is married with two withholding allowances. His annual salary is $65,000, and his standard workweek is 37.5 hours. During a pay period, he worked 10 hours overtime. Compute Dennis’s gross pay for the period ending August 18, 20XX.

a. What is his regular wage for the pay period?

b.What are his overtime earnings?

c. What is his gross pay?

a. $2,708.33 ($65,000/24 pay periods)

b. $500 [($65,000/52 weeks/37.5 hours per week) * 1.5 * 10 hours of overtime]

c. $3,208.33 ($2,708.33 + $500)

You might also like to view...

The Fashion Store, a new startup, sets product prices so that revenues will equal manufacturing and marketing costs. The pricing strategy used by the company is referred to as ________ pricing

A) good-value B) value-added C) cost-plus D) competition-based E) target return

North Americans are perceived by members of some cultures as too casual in their presentation style

Indicate whether the statement is true or false

Richly Merchandise, Inc, contracts with Stand-Rite Contractors to build a store. Stand-Rite assigns the contract to Town Builders, which has a poor record of completing projects. Richly could most successfully argue that the con¬tract cannot be assigned because

a. Richly did not consent to the assignment. b. Richly did not receive adequate consideration for the assignment. c. an assignment will significantly increase the risk of nonperformance. d. Town Builders was not an original party to the deal.

Use of the the single-period model will maximize profit in every season

Indicate whether the statement is true or false