Select the term from the list provided that best describes each of the following descriptions.Your AnswerDescriptionTerm?A. The process of dividing a cost into parts and apportioning among cost objects1. Allocation?B. Items for which managers need to know the cost. Examples include products and departments.2. Allocation base?C. Factor determined by taking the total cost to be allocated and dividing by the appropriate cost driver3. Allocation rate?D. Costs that cannot be easily traced to a cost object4. Overhead cost?E. Adding together many costs to determine the cost of a cost object5. Cost?F. Another term used for a cost driver6. Cost accumulation?G. A factor such as a measure of activity that causes costs to increase or decrease7. Cost driver?H. Costs that are easily

traced to a cost object8. Cost objects?I. The amount of resources that must be sacrificed to obtain some benefit9. Cost pool?J. A Collection of individual costs that are added together and then allocated to cost objects10. Direct costs?K. Indirect costs of doing business that cannot be traced directly to a product, department, or process. Example: Depreciation11. Indirect costs

What will be an ideal response?

| Your Answer | Description | Term |

| 1 | A. The process of dividing a cost into parts and apportioning among cost objects | 1. Allocation |

| 8 | B. Items for which managers need to know the cost. Examples include products and departments. | 2. Allocation base |

| 3 | C. Factor determined by taking the total cost to be allocated and dividing by the appropriate cost driver | 3. Allocation rate |

| 11 | D. Costs that cannot be easily traced to a cost object | 4. Overhead cost |

| 6 | E. Adding together many costs to determine the cost of a cost object | 5. Cost |

| 2 | F. Another term used for a cost driver | 6. Cost accumulation |

| 7 | G. A factor such as a measure of activity that causes costs to increase or decrease | 7. Cost driver |

| 10 | H. Costs that are easily traced to a cost object | 8. Cost objects |

| 5 | I. The amount of resources that must be sacrificed to obtain some benefit | 9. Cost pool |

| 9 | J. A Collection of individual costs that are added together and then allocated to cost objects | 10. Direct costs |

| 4 | K. Indirect costs of doing business that cannot be traced directly to a product, department, or process. Example: Depreciation | 11. Indirect costs |

You might also like to view...

A company had average total assets of $2,560,000, total cash flows of $1,860,000, cash flows from operations of $340,000, and cash flows from financing of $1,020,000. The cash flow on total assets ratio equals:

A. 13.28%. B. 39.80%. C. 12.58%. D. 72.66%. E. 23.86%.

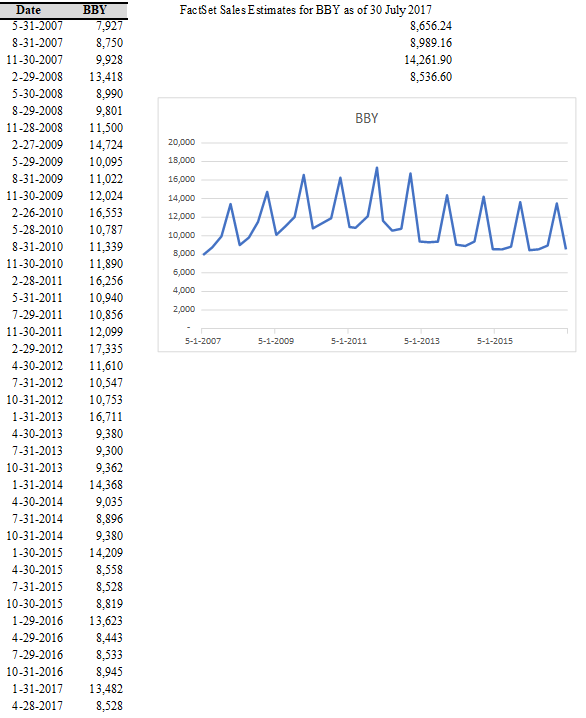

Using the Best Buy revenue data:

a) Create a sales forecast for the period of July 2017 to April 2018 using the Forecast Sheet. Be sure to include the forecast statistics so that you can judge the quality of the model.

b) What are the optimal smoothing constants (?, ?, and ?) according to this model, and how do they compare to those for the Holt-Winters Multiplicative Seasonal model?

c) According to FactSet, analysts are forecasting the following revenues for the next year. How do your numbers compare?

d) Square the RMSE from the Forecast Sheet to make it more comparable to our MSE. How does this compare to the MSE of the Holt-Winters Multiplicative Seasonal model?

The Investing budget is made up of the production budget, the direct materials purchases budget, and the direct labor cost budget

Indicate whether the statement is true or false

________ is an effort to attain objectives by attacking or hurting others.

A. Assertiveness B. Acquiescence C. Autonomy D. Aggression