Which statement most accurately describes the effect financial technology has had on the demand for money in the United States?

A) Advances in financial technology have all increased the demand for money.

B) Some advances in financial technology have increased the demand for money while others have decreased it.

C) It is not possible to tell what would be the effect because financial technology has not changed over the past three decades.

D) Advances in financial technology have all decreased the demand for money.

E) Advances in financial technology have had no effect on the demand for money.

B

You might also like to view...

In a sequential game

A) players try to figure out an opponent's future response in making their own moves. B) all players make decisions at the same time. C) players draw lots and take turns. D) players figure out their own moves and then forecast their following moves.

If the international value of the dollar rises, the

a. aggregate demand curve will shift inward. b. aggregate supply curve will shift outward. c. U.S. price level will fall. d. All of the above are correct.

Which set of changes is definitely predicted to raise Real GDP in the short run?

A) Wealth increases and there is an adverse supply shock. B) Individuals expect higher (future) incomes and wage rates fall. C) Business taxes rise and wage rates fall. D) The U.S. dollar appreciates and there is a beneficial supply shock. E) none of the above

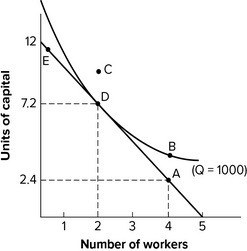

Refer to the graph shown. If the firm's total cost is $375, labor must cost:

A. $5 per unit. B. $62.50 per unit. C. $6 per unit. D. $75 per unit.