On December 1, 2018, Foggy Bottom Co. borrowed $360,000 from Atlantic National Bank, and signed a 9% note payable due in one year. Interest on the note is due at maturity.Required:Part a. Prepare the journal entry to record the borrowing transaction.Part b. Prepare the required adjusting entry on December 31, 2018.Part c. Prepare the journal entry to record the payment of the interest on December 1, 2019.Part d. Prepare the journal entry to record the payment of the note on December 1, 2019.

What will be an ideal response?

Part a

| 12/01/18 | Cash | 360,000 | ? |

| ? | Note Payable | ? | 360,000 |

| 12/31/18 | Interest Expense ($360,000 × 0.09 × 1/12) | 2,700 | ? |

| ? | Interest Payable | ? | 2,700 |

| 12/01/19 | Interest Payable | 2,700 | ? |

| ? | Interest Expense ($360,000 × 0.12 × 11/12) | 29,700 | ? |

| ? | Cash | ? | 32,400 |

| 12/01/19 | Note Payable | 360,000 | ? |

| ? | Cash | ? | 360,000 |

You might also like to view...

Monopoly power is an extreme amount of market power

Indicate whether the statement is true or false

Do successful organizations employ only managers or only leaders?

What will be an ideal response?

True or false, tariffs and other trade barriers have been significantly reduced among many countries, allowing a much more competitive global economy

Indicate whether the statement is true or false

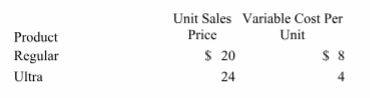

A firm sells two products, Regular and Ultra. For every unit of Regular the firm sells, two units of Ultra are sold. The firm's total fixed costs are $1,612,000. Selling prices and cost information for both products follow. What is the firm's break-even point in units of Regular and Ultra?

A) 31,000 Regular units and 31,000 Ultra units.

B) 31,000 Regular units and 62,000 Ultra units.

C) 10,333 Regular units and 20,667 Ultra units.

D) 36,167 Regular units and 72,333 Ultra units.

E) 62,000 Regular units and 31,000 Ultra units.