What do you understand by the term ‘social construction of reality?’ Thinking of any organization that you have been a part of, how did it seek to construct your reality?

What will be an ideal response?

The ideal answer will demonstrate a good understanding of ‘social constructivism’ and will discuss the concept of rationalities from the point of view that rationality is something that is constructed rather than natural. A good answer will provide clear examples of how bureaucracy adheres to rationality and would by its very nature abhor the social construction of reality (i.e. the only sense to be made is that which the bureaucracy allows, because that’s what the rules say! An outstanding example would provide instances of organizations constructing social reality, such as the Bush administration’s spin on the need for the invasion of Iraq, and their subsequent accounts of events there.

You might also like to view...

ever legally cleared for use, what will likely be the biggest obstacle to widespread adoption of the fMRI polygraph?

a. cultural bias b. cost c. public stigma d. privacy concerns

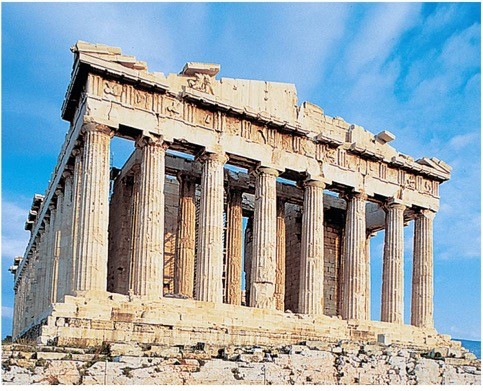

Parthenon PhotoThe Parthenon, shown in the photo above, evokes strong feelings from consumers in Greece and is referred to as the "holy rock." Coca Cola marketers did not respect that this ________, when used in a marketing campaign by replacing the columns with Coke bottles, would arouse such an angry response in that country.

Parthenon PhotoThe Parthenon, shown in the photo above, evokes strong feelings from consumers in Greece and is referred to as the "holy rock." Coca Cola marketers did not respect that this ________, when used in a marketing campaign by replacing the columns with Coke bottles, would arouse such an angry response in that country.

A. cultural symbol B. back translation C. anthropomorphic code D. semantic representation E. civil analysis

According to Immanuel Kant's categorical imperative, _____.

A. individuals should not be used as a means to an end B. individuals need not be treated with respect all the time C. people should be allowed to pursue what is in their economic self-interest D. the self-interest of human beings is the government's providence

Belmont Corp. is considering the purchase of a new piece of equipment. The cost savings from the equipment would result in an annual increase in net income after tax of $200,000. The equipment will have an initial cost of $1,000,000 and have an 8-year life. If there is no salvage value of the equipment, what is the accounting rate of return?

A. 15% B. 40% C. 20% D. 12.5%