Under a gold standard in which France defined one franc to be worth 1/50th of an ounce of gold and the U.S. defined one dollar to be worth 1/10th of an ounce of gold, then

A. one U.S. dollar would exchange for five French francs.

B. the French franc is worth only one-tenth as much as the dollar is worth.

C. the U.S. dollar is valued at one-fifth of the French franc.

D. on French franc would exchange for ten dollars.

A. one U.S. dollar would exchange for five French francs.

You might also like to view...

Marginal utility theory predicts that a rise in the price of a banana results in

A) the demand curve for bananas shifting rightward. B) the demand curve for bananas shifting leftward. C) a movement upward along the demand curve for bananas. D) a movement downward along the demand curve for bananas.

Which of the following is least likely to be an example of peak/off-peak pricing?

a. breakfast cereals b. hotels c. wireless service d. electricity

If most people found the lifestyle of an assembly-line worker less desirable relative to that of persons in other professions, one would expect the return on the human capital investment of

a. assembly-line workers to be higher than that of persons in other professions. b. assembly-line workers to be lower than that of persons in other professions. c. assembly-line workers and that of persons in other professions to be nonetheless equal. d. both assembly-line workers and persons in other professions to be unaffected by the subjective preferences of investors.

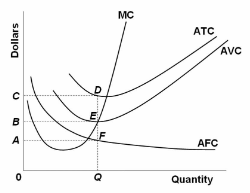

Refer to the diagram. The vertical distance between ATC and AVC reflects:

A. the law of diminishing returns.

B. the average fixed cost at each level of output.

C. marginal cost at each level of output.

D. the presence of economies of scale.