A coupon bond pays interest semi-annually, matures in five years, has a par value of $1,000, a coupon rate of 12%, and an effective annual yield to maturity of 10.25%. The price the bond should sell for today is

A. $922.77.

B. $924.16.

C. $1,075.80.

D. $1,077.20.

E. None of the options are correct.

D. $1,077.20.

(1.1025)1/2- 1 = 5%, N = 10, I/Y = 10%, PMT = 60, FV = 1000, Þ PV = 1,077.22.

You might also like to view...

The following information was taken from the operating activity section of the 2016 statement of cash flows for Limited Corp: Additions to net income: Change in accounts payable $2,000 Deductions from net income: Change in inventories 8,000 Based on the information provided, which one of the following conclusions is correct?

a. Inventories increased $8,000 in 2016. b. The direct method was used to prepare the operating section of the cash flow statement. c. Cash payments of merchandise exceeded cost of goods sold by $2,000. d. Accounts payable decreased $2,000 in 2016.

"I'm really hyped up about the merger!" is an example of

a. stereotyping. b. a colloquialism. c. a confusing message. d. none of these choices.

If an employer reasonably anticipates a strike by some of its employees, it may legally arrange a(n) ________ to prevent these employees from entering the work premise

A) strike B) picketing C) employer lockout D) employee lockout

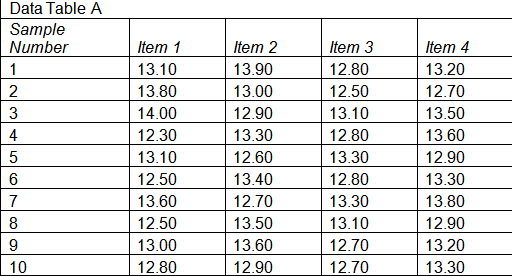

Refer to Data Table A. The value for D3 is ______.

a. 0

b. 0.223

c. 2.059

d. 2.282