Professors Harry Markowitz and William Sharpe received their Nobel Prize in Economics for their contributions to the

A) options pricing model.

B) theories of working capital management.

C) theories of portfolio based management and the risk along with return on securities.

D) theories of international capital budgeting.

C) theories of portfolio based management and the risk along with return on securities.

You might also like to view...

When computing the rate earned on total common stockholders' equity, preferred stock dividends are subtracted from net income

a. True b. False Indicate whether the statement is true or false

Which statements about data warehousing is not correct?

a. The data warehouse should be separate from the operational system. b. Data cleansing is a process of transforming data into standard form. c. Drill-down is a data-mining tool available to users of OLAP. d. Normalization is a requirement of databases included in a data warehouse.

Which of the following is not included in conversion costs?

a. Indirect labor b. Direct labor c. Direct materials d. Overhead

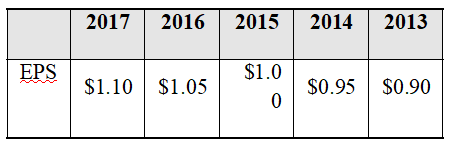

The Claustrophobic Solution, Inc., a residential window and door manufacturer, has the following historical record of earnings per share (EPS) from 2013 to 2017:

The company’s payout ratio has been 60% over the last five years and the last quoted price of the firm’s stock was $10. Flotation costs for new equity will be 7%. The company has 30,000,000 common shares outstanding and a debt-equity ratio of 0.50.

a) If dividends are expected to grow at the same arithmetic average growth rate of the last five years, what is the dividend payment in 2018?

b) Calculate the firm’s cost of retained earnings and the cost of new common equity using the constant growth dividend discount model.

c) Calculate the break-point associated with retained earnings.

d) If the Claustrophobic Solution’s after-tax cost of debt is 9%, what is the WACC with retained earnings? With new common equity?

e) Assuming that the cost of debt is constant, create a marginal cost of capital (MCC) schedule. Be sure to use a Scatter chart and make it a step function.