Which of the following statements is not correct regarding taxes?

A. The largest source of state and local governments tax revenue is sales and excise taxes.

B. The largest source of federal government tax revenue is individual income taxes.

C. A sales tax on food is a regressive tax.

D. A proportional tax is equal to a fixed dollar amount.

Answer: D

You might also like to view...

Refer to Figure 15-14. In the figure above, suppose the economy in Year 1 is at point A and is expected in Year 2 to be at point B. Which of the following policies could the Federal Reserve use to move the economy to point C?

A) increase the required-reserve ratio B) sell Treasury bills C) decrease income taxes D) buy Treasury bills

A country's GNP is always larger than its GDP

Indicate whether the statement is true or false

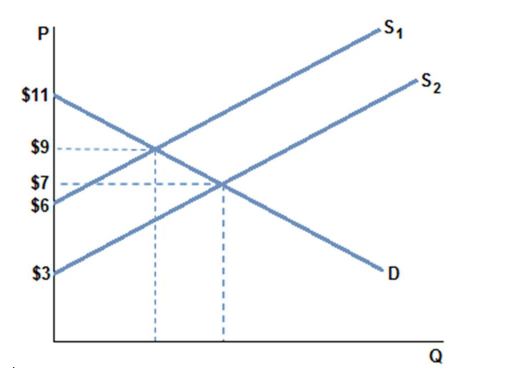

Assume the market is in equilibrium in the graph shown at demand D and supply S1. If the supply curve shifts to S2, and a new equilibrium is reached, equilibrium quantity will increase from 4 to 4.5 units. Which of the following is true?

A. Producer surplus increases by $3.00.

B. Producer surplus decreases by $8.50.

C. Producer surplus increases by $7.50.

D. Producer surplus decreases by $16.

Economists view pollution as an economic problem that arises because

a. private enterprise always minimizes the amount of pollution produced b. profitable firms rarely pollute c. as the economy grows, the level of pollution declines d. firms that pollute do not pay the full social cost of producing their output e. pollution costs are borne by the consumer