When accounting for property taxes, which of the following accounts normally would not be credited?

a. Prepaid Property Taxes

b. Cash

c. Estimated Property Taxes Payable

d. Property Taxes Expense

D

You might also like to view...

In Fiedler's contingency leadership model, the amount of influence a leader has in his or her immediate work environment is called his or her

A. coercive power. B. leadership style. C. readiness. D. situational control. E. task structure.

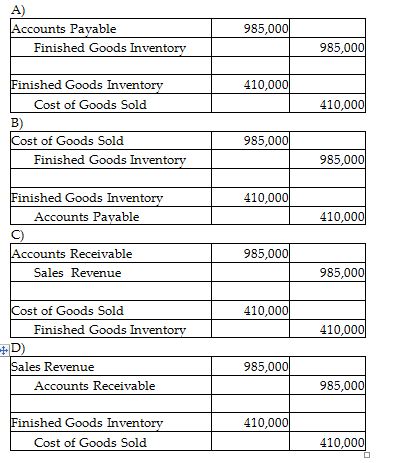

Using a job order costing system, Jabari Company sold jobs on account with a selling price of $985,000 and a cost of $410,000. Assume the company uses the perpetual inventory system. The journal entries required to record this transaction are:

Firms account for material errors in previously issued financial statements by retrospectively restating net income of prior periods and adjusting the beginning balance in Retained Earnings of the current period

Indicate whether the statement is true or false

Which of the following should be deducted from net income in calculating net cash flow from operating activities using the indirect method?

A) a decrease in inventory B) a decrease in accounts payable C) preferred dividends declared and paid D) a decrease in accounts receivable