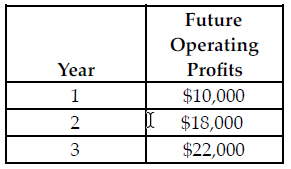

Refer to the table below. If the discount rate is 5 percent and the cost of the investment is $45,000, which of the following is true regarding a profit-maximizing manager?

The above table shows the future operating profits from an investment. The future operating profits are earned at the end of each of the respective years.

A) The manager should not make the investment because the net present value is positive.

B) The manager should not make the investment because the net present value is negative.

C) The manager should make the investment because the net present value is positive.

D) The manager should make the investment because the net present value is negative.

B) The manager should not make the investment because the net present value is negative.

You might also like to view...

Since 1970, as a percent of GDP, M1 held has steadily decreased. Which of the following can account for this fact?

A) Real GDP has increased since 1970. B) The price level has risen since 1970. C) The nominal interest rate has steadily risen since 1970. D) The nominal interest rate has steadily fallen since 1970. E) Credit cards have become more widely available since 1970.

If a person is going to borrow $30,000 for a car and pay it off in monthly payments of $713.70 for 5 years, the internal rate of return is

A. 15%. B. 10%. C. 5%. D. 0%.

What generally causes the business cycle? What are the four phases of a single business cycle? What are the problems associated with the business cycle?

What will be an ideal response?

A firm in a perfectly competitive industry produces its profit-maximizing quantity, 40 units. Industry price is $3, total fixed costs are $45, and total variable costs are $60. The firm's economic profit is

A. $15. B. $30. C. $35. D. $60.