Which of the following is true of the 2008 Troubled Asset Relief Program?

A) It was a contractionary fiscal policy. B) It was a contractionary monetary policy.

C) It was a mix of monetary and fiscal policies. D) It mainly aimed at reducing inflation.

C

You might also like to view...

Which of the following formulas would you use to calculate the nominal wage rate?

A) nominal wage rate = real wage rate × CPI B) nominal wage rate = (real wage rate × CPI) × 100 C) nominal wage rate = (real wage rate × CPI) ÷ 100 D) nominal wage rate = (real wage rate ÷ CPI) × 100 E) nominal wage rate = real wage rate ÷ CPI

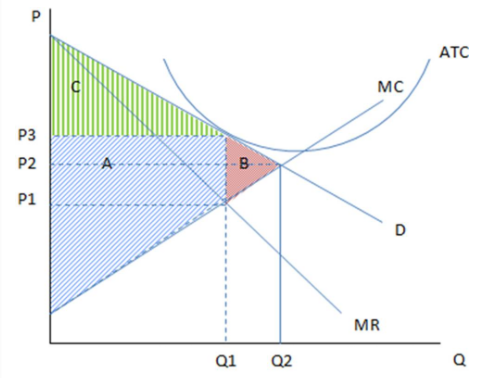

Assuming the firm in the graph is producing Q1 and charging P3, it is likely:

These are the cost and revenue curves associated with a firm.

A. in long-run equilibrium.

B. an efficient outcome.

C. not maximizing profits.

D. operating at a loss.

Which of the following represents causality rather than association?

a. In years that fashion dictates wider lapels on men's jackets, the stock market grows by at least 5 percent. b. Unemployment falls when the AFC champion wins the Super Bowl. c. Interest rates are higher in years ending with a 1 or a 6. d. Quantity demanded goes up when price falls because lower prices increase consumer purchasing power, and because some consumers of substitute goods switch.

The central idea of supply-side tax cuts is that certain types of tax cuts will increase

A. aggregate demand. B. aggregate supply. C. the supply of imports. D. the supply of money.