A blue-ocean strategy

A. involves abandoning efforts to beat out competitors in existing markets and instead invent a new industry or new market segment that renders existing competitors largely irrelevant and allows a company to create and capture altogether new demand.

B. works best when a company is the industry's low-cost leader.

C. involves the use of highly creative, never-used-before strategic moves to attack the competitive weaknesses of rivals.

D. involves an unexpected (out-of-the-blue) preemptive strike to secure an advantageous position in a fast-growing market segment.

E. is an offensive strike employed by a market leader that is directed at pilfering customers away from unsuspecting rivals to boost profitability.

Answer: A

You might also like to view...

In the analysis and interpretation of statistical results of people's opinions, likes, and preferences, it is best to describe results in which of the following ways?

a. raw numbers b. tabulated data c. percentages d. none of the above

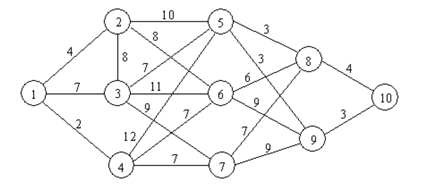

Find the shortest path through the following network using dynamic programming.

What will be an ideal response?

Creger Corporation, which makes landing gears, has provided the following data for a recent month: Budgeted production 7,900 gearsStandard machine-hours per gear 9.3 machine-hoursBudgeted supplies cost$6.20 per machine-hourActual production 8,300 gearsActual machine-hours 76,930 machine-hoursActual supplies cost (total)$479,438 Required:Determine the rate and efficiency variances for the variable overhead item supplies and indicate whether those variables are favorable or unfavorable.

What will be an ideal response?

Which of the following should be considered when assessing the financial impact of business decisions?

A) The amount of projected earnings B) The risk-return tradeoff C) The timing of projected earnings; i.e., when they are expected to occur D) All of the above