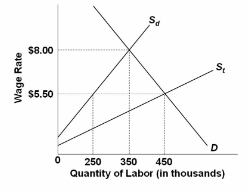

Refer to the given figure and assumptions. If the government effectively prevents illegal immigrants from working in this labor market, the equilibrium wage and level of employment are, respectively:

(1) Employers in this market are willing and able to ignore minimum wage laws;

(2) S d represents the supply of domestic-born (and legal immigrant) workers; (3) S t represents

the total supply of workers in this labor market (S d plus illegal immigrants); and (4) unless

otherwise stated, illegal immigration is not effectively blocked by the government.

A. $5.50 and 250,000.

B. $5.50 and 350,000.

C. $8.00 and 350,000.

D. $5.50 and 450,000.

C. $8.00 and 350,000.

You might also like to view...

With the assumption that some voluntary exchanges that would make both parties better off are somehow being blocked, we have the basis for a ________ macroeconomic model, such as those constructed by ________ economists

A) non-market-clearing, New Keynesian B) non-market-clearing, New Classical C) market-clearing, New Keynesian D) market-clearing, New Classical

A consequence of imposing a price floor is that

a. the new price (or price floor) is below the old equilibrium price b. an excess supply of the good is created at the floor price c. an excess demand for the good is created at the floor price d. the supply of the good decreases e. the demand for the good increases

Michael faces tradeoffs between consuming in the current period when he is young and consuming in a future period when he is old. Michael experiences a decrease in the current interest rate he earns on his savings. Michael will save

a. less in the current period if the substitution effect is greater than the income effect. b. less in the current period if the income effect is greater than the substitution effect. c. more in the current period if the substitution effect is greater than the income effect. d. more in the current period, regardless of the sizes of the income and substitution effects.

Suppose the Federal Reserve increases bank reserves and banks lend out some of these reserves, but at some point banks still have $5 million more they wish to lend out. If the reserve requirement is 10 percent, how much more money can banks create if they lend out the remaining amount?

a. $55 million b. $50 million c. $45 million d. $40 million