Considering leverage, can you explain why a mortgage lender would want borrowers to have larger down payments, and when the borrower doesn't the mortgage lender may require mortgage insurance?

What will be an ideal response?

We saw that leverage can do two things for the borrower: it will increase the expected return but it also increases risk. As an example, a homebuyer putting 10% down rather than 20% increases the leverage factor from 5 to 10, this will double the expected return for the borrower but also double the risk. The mortgage lender (the counterparty) is certainly concerned with the risk since the doubling of the risk also works against them. As a result, they would want a larger down payment or insurance protection in the event that the borrower does not meet their obligations.

You might also like to view...

A depository institution is a firm that takes deposits from ________ and makes loans to ________

A) households and firms; other households and firms B) firms only; households only C) households only; firms only D) firms only; other firms only

In the above figure, the total cost curve is curve

A) A. B) B. C) C. D) none of the curves in the figure.

Which of the following best describes the consumer optimum?

A) MUa/Pa = TUb/Pb B) MUa/TUa = Pa C) MUa/Pa = MUb/Pb = . . . = MUz/Pz. D) change in TU/change in P = MU

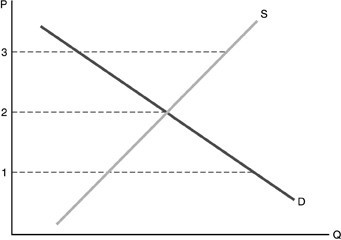

In the above figure, a shortage could be caused by a government price ceiling set at

In the above figure, a shortage could be caused by a government price ceiling set at

A. $2.50. B. $2.00. C. $1.00. D. $3.00.