A payroll tax is a

a. fixed number of dollars that every firm must pay to the government for each worker that the firm hires.

b. tax that each firm must pay to the government before the firm can hire workers and operate its business.

c. tax on the wages that firms pay their workers.

d. tax on all wages above the minimum wage.

c

You might also like to view...

What is the difference between explicit collusion and implicit collusion?

What will be an ideal response?

Which of the following is a possible explanation for the shift of the production possibilities curve illustrated?

a. an increase in the number of idle factories b. a technological advance that affects only bicycle production c. a technological advance that affects both pizza and bicycle production d. a decrease in the quantity of labor available due to emigration

Along the horizontal axis of the production function we typically measure

a. revenue. b. the marginal product of the input. c. the quantity of input. d. the quantity of output.

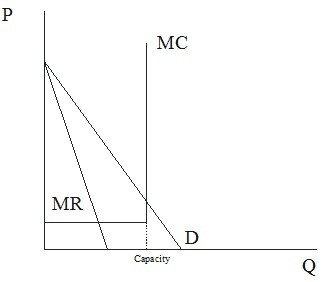

Referring to Figure 34.1, the number of tickets that this promoter will choose to sell will  Figure 34.1

Figure 34.1

A. be where the demand curve crosses the marginal cost curve. B. sell out the facility. C. be more than capacity. D. be such that there are many empty seats.