Refer to Scenario 9.10 below to answer the question(s) that follow. SCENARIO 9.10: Investors put up $1,040,000 to construct a building and purchase all equipment for a new cafe. The investors expect to earn a minimum return of 10 percent on their investment. The cafe is open 52 weeks per year and serves 900 meals per week. The fixed costs are spread over the 52 weeks (i.e. prorated weekly). Included in the fixed costs is the 10% return to the investors and $2,000 in other fixed costs. Variable costs include $2,000 in weekly wages, and $600 per week in materials, electricity, etc. The cafe charges $6 on average per meal.Refer to Scenario 9.10. The economic profit is

A. -$3,600.

B. -$1,200.

C. $0.

D. $5,400.

Answer: B

You might also like to view...

If the required reserve ratio is 10% and the Fed purchases $20 million worth of securities, what is the simple deposit multiplier and what happens to the amount of deposits in the banking system? Assume that banks do not hold excess reserves and the

public does not change its currency holdings.

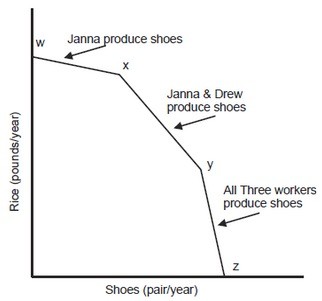

The following graph is the production possibility curve for a three-person economy, with workers Janna, Drew, and Karl. The slope of the PPC between points X and Y is determined by ________ opportunity cost.

The slope of the PPC between points X and Y is determined by ________ opportunity cost.

A. Janna's B. Drew's C. Janna and Drew's D. Kari's

The demand curve for the product of a monopolistically competitive firm slopes downward because

A) products are perceived by consumers as different. B) products are homogeneous. C) people only care about price when they buy a good. D) the firm's goal is to maximize profits.

The equation (MPL/PL) = (MPK/PK) represents

A. profit maximization. B. the short-run production function. C. diminishing marginal returns. D. cost minimization.