Who formulated the theory that government borrowing may function like an increase in taxes in the sense of reducing current consumption and business expenditures?

A. David Ricardo

B. John Maynard Keynes

C. Jean Baptiste Say

D. Adam Smith

Answer: A

You might also like to view...

In the "cost of capital channel" of monetary policy, a higher interest rate __________ spending

A) raises consumption B) raises investment C) lowers consumption D) lowers investment

The division of a resource's earnings between economic rent and opportunity cost depends on the resource owner's

a. elasticity of labor supply b. price elasticity of labor demand c. income elasticity of labor demand d. cross-price elasticity of demand e. marginal revenue product

When negative externalities like pollution exist, competition leads to:

a. a socially efficient outcome. b. too few goods being bought and sold. c. a market equilibrium price that is too high. d. more production than would be efficient.

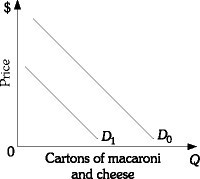

Refer to the information provided in Figure 3.2 below to answer the question(s) that follow. Figure 3.2Refer to Figure 3.2. Which of the following would be most likely to cause the demand for macaroni and cheese to shift from D1 to D0?

Figure 3.2Refer to Figure 3.2. Which of the following would be most likely to cause the demand for macaroni and cheese to shift from D1 to D0?

A. an increase in the price of flour used to make macaroni and cheese B. an increase in income, assuming macaroni and cheese is a normal good C. an increase in the price of macaroni and cheese D. an increase in the quantity demanded for macaroni and cheese