If a tax rate falls as a person's income rises, the tax is a:

a. proportional tax.

b. progressive tax.

c. regressive tax.

d. poll tax.

e. constant tax.

c

You might also like to view...

When the price of a good changes, the amount of that good that buyers wish to buy changes:

A. solely because of the income effect. B. only if the substitution effect and the income effect do not cancel out each other. C. solely because of the substitution effect. D. because of both the substitution and the income effects.

Use the table below to answer the following question.OutputTotal Cost0$10120228338453573698The marginal cost of producing 3 units of output is

A. $28. B. $0. C. $10. D. $38.

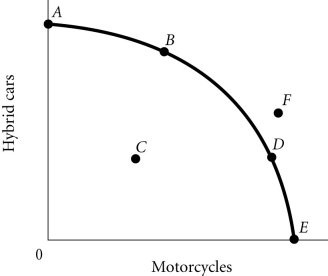

Refer to the information provided in Figure 2.4 below to answer the question(s) that follow. Figure 2.4According to Figure 2.4, Point E necessarily represents

Figure 2.4According to Figure 2.4, Point E necessarily represents

A. only motorcycles being produced. B. overallocation of resources. C. an impossible production point. D. technological advancement.

A unique feature of an monopolistic industry is:

A. Low barriers to entry B. Standardized products C. Diminishing marginal returns D. Mutual interdependence