To resolve the problem of the negative effect of conspicuous consumption goods on society's welfare, an economist most likely would make the suggestion that:

A. conspicuous consumption goods should be taxed.

B. conspicuous consumption goods should be subsidized.

C. nothing should be done because laissez faire is the best policy.

D. conspicuous consumption goods should be eliminated.

Answer: A

You might also like to view...

Playing the game in Scenario 13.13 sequentially would

A) not change the equilibrium. B) change the equilibrium to (R1,C1 ). C) change the equilibrium to (R2,C1 ) if R moved first. D) change the equilibrium to (R2,C1 ) if C moved first. E) change the equilibrium to (R2,C2 ).

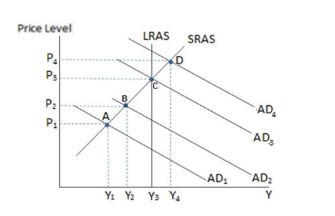

According to the graph shown, if the government decides to increase taxes, it is most likely at equilibrium:

A. A

B. B

C. C

D. D

Lawrence is a photographer. He has $230 to spend and wants to buy either a flash for his camera or a new tripod. Both the flash and tripod cost $230, so he can only buy one. This illustrates the principle that

a. trade can make everyone better off. b. people face trade-offs. c. rational people think at the margin. d. people respond to incentives.

In an oligopoly market, the Nash Equilibrium a. is a stable outcome despite providing a lower total profit level. b. leads to zero economic profit once the equilibrium is reached. c. results in a output level below that for a monopoly

d. always result in the maximum profit for all firms.