Given a 25 percent reserve ratio, assume the commercial banking system is loaned up. Now assume the reserve ratio is reduced to 20 percent. As a result of this reduction:

A. we can expect bank lending and bank profits to decline.

B. each dollar of bank reserves will now support a maximum of $5 of checkable deposits.

C. the banking system must now reduce outstanding loans by 5 percent.

D. the banking system can now increase lending by 5 percent.

B. each dollar of bank reserves will now support a maximum of $5 of checkable deposits.

You might also like to view...

The activists believe that

A) the time required for flexible prices to bring the economy back to the natural rate of unemployment is relatively short. B) the IS curve is relatively flat because of the broad range of assets whose demand is very sensitive to changes in the interest rate. C) the time required for flexible prices to return the economy to the natural level of real GDP is intolerably long. D) the severity of the Great Depression was primarily related to the large decline in the supply of money.

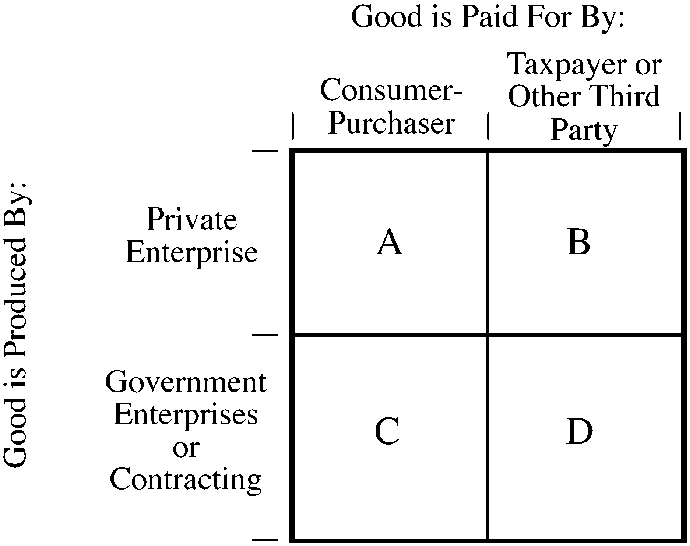

Figure 6-2

illustrates the four possibilities of the structure of production and consumption for a good or service. In which case is the incentive of producers to be efficient and the incentive for consumers to economize the weakest?

a. A

b. B

c. C

d. D

If there is a recessionary gap, the appropriate fiscal policy would be contractionary.

a. true b. false

One of the primary achievements of the Uruguay Round of GATT negotiations was the:

A. Elimination of import quotas B. Creation of a worldwide free trade zone C. Establishment of the World Trade Organization (WTO) D. Establishment of equal, nondiscriminatory treatment for all members