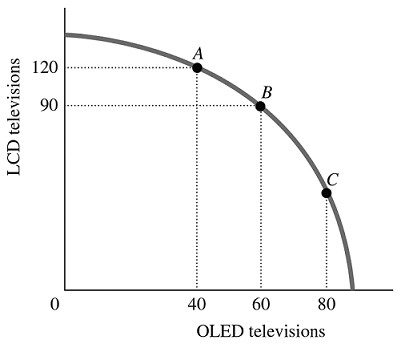

Refer to the information provided in Figure 2.5 below to answer the question(s) that follow. Figure 2.5Refer to Figure 2.5. The economy is currently at Point B. The opportunity cost of moving from Point B to Point A is the

Figure 2.5Refer to Figure 2.5. The economy is currently at Point B. The opportunity cost of moving from Point B to Point A is the

A. 120 LCD TVs that must be forgone to produce 20 additional OLED TVs.

B. 30 LCD TVs that must be forgone to produce 40 additional OLED TVs.

C. 20 OLED TVs that must be forgone to produce 30 additional LCD TVs.

D. 40 OLED TVs that must be forgone to produce 120 additional LCD TVs.

Answer: C

You might also like to view...

Refer to Figure 7-5. With insurance and a third-party payer system, what price do consumers pay for medical services?

A) $40 B) $55 C) $65 D) > $65

Even if the Fed could completely control the money supply, monetary policy would have critics because

A) the Fed is asked to achieve many goals, some of which are incompatible with others. B) the Fed's goals do not include high employment, making labor unions a critic of the Fed. C) the Fed's primary goal is exchange rate stability, causing it to ignore domestic economic conditions. D) it is required to keep Treasury security prices high.

Which of the following will cause a movement along the demand curve for shoes?

A) an increase in the price of socks B) an increase in income C) an increase in the price of shoes D) all of the above

Industry A has four firms. The largest firm in Industry A has more than 90 percent of the market share. Industry B also has four firms, but each of those four firms in Industry B has 25 percent of the market share. The Herfindahl-Hirschman index will be

A) the same for both industries, but the four-firm concentration will be larger for Industry B than Industry A. B) the same for both industries, but the four-firm concentration will be larger for Industry A than Industry B. C) larger for Industry B than Industry A, but the four-firm concentration will be the same. D) larger for Industry A than Industry B, but the four-firm concentration will be the same.