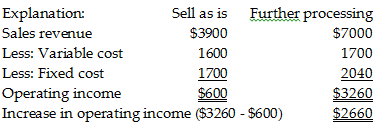

A company produces 1000 packages of cat food per month. The sales price is $3.90 per pack. Variable cost is $1.60 per unit, and fixed costs are $1700 per month. Management is considering adding a vitamin supplement to improve the value of the product. The variable cost will increase from $1.60 to $1.70 per unit, and fixed costs will increase by 20%. The company will price the new product at $7 per pack. How will this affect operating income?

A) Operating income will decrease by $2660 per month.

B) Operating income will remain unchanged.

C) Operating income will decrease by $1060 per month.

D) Operating income will increase by $2660 per month.

D) Operating income will increase by $2660 per month.

You might also like to view...

The cost of goods manufactured for a period is the amount transferred from work in process inventory to finished goods inventory during the period

Indicate whether the statement is true or false

Any typographical error in a contract will be rectified by the court if one party requests it

Indicate whether the statement is true or false

The term " graphics" refers to:

a. tables, bar charts, and line charts. b. pie charts, pictograms, and maps. c. flow charts, diagrams, and photographs. d. All of these are correct.

According to the 1994 amendments to the Bankruptcy Act, the U.S. Judicial Conference must adjust for inflation the dollar amounts of the requirements for filing involuntary cases, priorities, and exemptions every seven years

a. True b. False Indicate whether the statement is true or false