Matty and Rudy are the same age, live in the same town, and hold similar jobs a similar distance from their respective homes. They are so similar, in fact, that to the insurance company, they look the same and are offered the same insurance options. However, Matty has never been a particularly good driver and so buys a lot of auto insurance. Rudy, on the other hand, takes pride in being an excellent driver and so only carries the minimum insurance required. This example illustrates the potential for :

A. risk pooling.

B. risk aversion.

C. adverse selection.

D. diversification.

C. adverse selection.

You might also like to view...

If there is 3 percent frictional unemployment, 4 percent structural unemployment, and -2 percent cyclical unemployment, then the natural rate of unemployment equals:

A. 5%. B. 1%. C. 2%. D. 7%.

About how many malnourished children under age five are there in the developing world?

a. 20 million b. 150 million c. 500 million d. 1 billion e. 2 billion

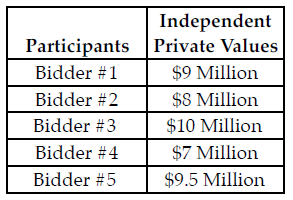

Refer to the table below. Recall that the bidders only know their own private value of the item and they do not know the other participants' private values. Further, assume each participant will submit bids using their optimal strategy. If the participants are bidding in a Dutch auction, Bidder ________ wins the auction and pays ________.

The table above lists the independent private values of five participants in an auction. Each of the bidders only knows their own value and does not know the private values of the other participants.

A) #3; a value less than $10 million and greater than $9.5 million

B) #5; a value less than $10 million and greater than $9.5 million

C) #5; 9.5 million

D) #3; $10 million

Suppose the 12-month interest rate on a U.S. Treasury bill is 16 percent, and the one-year interest rate on a comparable British Treasury bill is 6 percent. The exchange rate today is $2.00 per pound. What must be the expected exchange rate at maturity for interest rate parity to hold?

a. $1.00 = 0.50 pound b. $1.00 = 0.75 pound c. 1 pound = $2.20 d. 1 pound = $1.80 e. 1 pound = $2.50