The level of crowding out associated with a tax cut will be smaller if the tax change has a supply-side effect than it will be if it only has a demand-side effect

Indicate whether the statement is true or false

TRUE

You might also like to view...

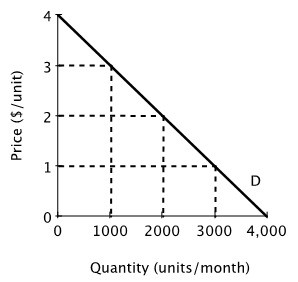

Quick Buck and Pushy Sales produce and sell identical products and face zero marginal and average cost. Below is the market demand curve for their product.  If Quick Buck and Pushy Sales decide to collude and work together as a monopolist with each firm producing half the quantity demanded by the market at the monopoly price, then what will be Quick Buck's economic profit?

If Quick Buck and Pushy Sales decide to collude and work together as a monopolist with each firm producing half the quantity demanded by the market at the monopoly price, then what will be Quick Buck's economic profit?

A. $4,000 B. $3,000 C. $1,000 D. $2,000

Buying insurance and then never making a claim:

A. is considered by economists to be irrational behavior. B. means buying the insurance was a bad decision. C. does not mean buying the insurance was a bad decision. D. is a poor use of money.

If goods X and Y are complements, then the cross price elasticity of demand between them will be

a. positive. b. negative. c. zero. d. infinity.

If economists wanted to measure the net gain in economic well-being to producers, they would refer to ______.

a. producer surplus b. consumer surplus c. market price d. deadweight loss