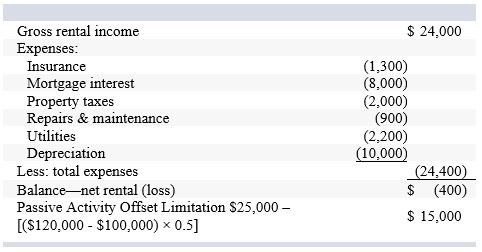

Ashton owns a condominium near San Diego, California. This year, he incurs the following expenses in connection with his condo: Insurance$1,300Mortgage interest 8,000Property taxes 2,000Repairs and maintenance 900Utilities 2,200Depreciation 10,000 During the year, Ashton rented the condo for 120 days and he received $24,000 of rental receipts. He did not use the condo at all for personal purposes during the year. Ashton is considered to be an active participant in the property. Ashton's AGI from all sources other than the rental property is $120,000. Ashton does not have passive income from any other sources. What is Ashton's AGI?

What will be an ideal response?

$119,600

$120,000 + ($400)

You might also like to view...

An investor purchased 500 shares of common stock, $25 par, for $19,250 . Subsequently, 100 shares were sold for $35 per share. What is the amount of gain or loss on the sale?

a. $3,500 gain b. $350 gain c. $350 loss d. $500 gain

On May 31, a retail firm pays rent of $2,400 for the month of May. When this transaction is recorded in the cash payments journal, ________.

A) assets and equity will increase by $2,400 B) assets and liabilities will decrease by $2,400 C) assets and equity will decrease by $2,400 D) liabilities and equity will increase by $2,400

List and briefly describe the three types of defects that are the cornerstone of a person's case in a lawsuit for product liability based on a defective product

Briefly describe the Americans with Disabilities Act.

What will be an ideal response?