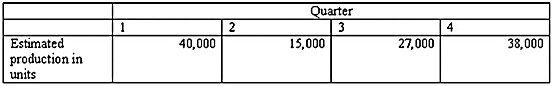

Morris Company makes one product, and it expects to incur a total of $600,000 in indirect (overhead) costs during the current year. Production of the product for the year is expected to be: Required:1) Calculate a predetermined overhead rate based on the number of units of product expected to be made during the current year.2) Assuming that direct materials and direct labor costs are $10 and $15, respectively, determine the total cost per unit using the overhead rate you calculated in part (1).

Required:1) Calculate a predetermined overhead rate based on the number of units of product expected to be made during the current year.2) Assuming that direct materials and direct labor costs are $10 and $15, respectively, determine the total cost per unit using the overhead rate you calculated in part (1).

What will be an ideal response?

1) Predetermined overhead rate = $600,000 ÷ 120,000 units = $5 per unit

2) Cost per unit = $10 + $15 + $5 = $30

You might also like to view...

A separate record of each employee's earnings is called a(n)

a. payroll register; b. employee's earnings record; c. payroll ledger; d. payroll check; e. wage statement.

A description of the physical arrangement of records in the database is

a. the internal view b. the conceptual view c. the subschema d. the external view

A(n) ________ is a written representation of a salesperson's completed activities

A) bill of sale B) call report C) tender D) sales quotation E) contract of sale

Most entrepreneurs have little difficulty with gathering market information.

Answer the following statement true (T) or false (F)