On January 1 . 2014, Amber Inc purchased 30 percent of the outstanding common stock of Collar Corporation for $516,000 cash. Amber is accounting for this investment using the equity method. On the date of acquisition, the fair value of Collar' net assets was $1,240,000 . Amber has determined that the excess of the cost of the investment over its share of Collar' net assets is attributable to

goodwill. Collar' net income for the year ended December 31 . 2014, was $360,000 . During 2014, Collar declared and paid cash dividends of $40,000 . There were no other transactions between the two companies. On December 31 . 2014, the investment in Collar should be recorded as

a. $396,000.

b. $468,000.

c. $612,000.

d. $624,000.

C

You might also like to view...

If a precise location on a map is important, a _________________ reference is better than a north arrow

a. GPS number b. longitude and latitude c. bibliographic d. source

Focus group interviews bring creative people and others involved in creative strategy development into contact with customers.

Answer the following statement true (T) or false (F)

Which of the following forms is submitted with a copy of the Form W-2 for each employee to the Social Security Administration?

A. Form W-3 B. Form 941 C. Form 940 D. Form W-4

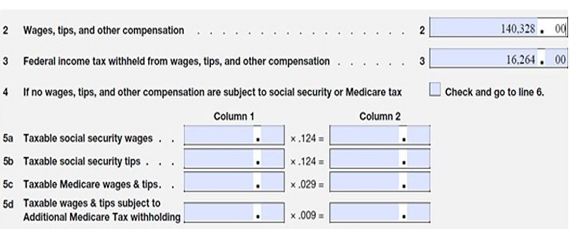

McBean Farms has the following information on their Form 941:

What amount should be entered in Column 2, Lines 5a and 5c? (Assume no Section 125 health insurance and that none of the employees had exceeded the Social Security wage base.)

A) $17,400.67 and $4,069.51, respectively

B) $140,328.00

C) $8,700.34 and $2,034.76, respectively

D) $156,592