Prisha is very uncomfortable because she received a larger bonus than other members of her work group. She is most likely from a ________ culture.

A. short-term oriented

B. feminine

C. global

D. uncertain

E. collectivistic

Answer: E

You might also like to view...

The term "polycentric" describes management's belief or assumption that each country in which a company does business is the same as the home country business

Indicate whether the statement is true or false

Sales Discounts is classified as what type of account?

a. a revenue b. an expense c. a contra-asset d. a contra-revenue

Mandich Co. had the following amounts for its assets, liabilities, and stockholders' equity accounts just before filing a bankruptcy petition and requesting liquidation: Book Value Net Realizable ValueCash$10,000 $10,000 Accounts receivable 100,000 60,000 Inventory 350,000 350,000 Land 110,000 75,000 Building and equipment 700,000 300,000 Accounts payable 100,000 Salaries payable 70,000 Notes payable (secured by inventory) 300,000 Employees' claims for contributions to pension plans 10,000 Taxes payable 80,000 Liability for accrued expenses 25,000 Bonds payable 500,000 Common stock 200,000 Additional paid-in capital 100,000 Retained earnings

(deficit) (115,000) ??Of the salaries payable, $30,000 was owed to an officer of the company. The remaining amount was owed to salaried employees who had not been paid within the previous 80 days: John Webb was owed $10,600, Samantha Jones was owed $15,000, Sandra Johnson was owed $11,900, and Dennis Roberts was owed $2,500. The maximum owed for any one employee's claims for contributions to benefit plans was $800. Estimated expense for administering the liquidation amounted to $40,000.?On a statement of financial affairs, what amount would have been shown as assets available to pay liabilities with priority and unsecured creditors? A. $495,000. B. $795,000. C. $445,000. D. $660,000. E. $390,000.

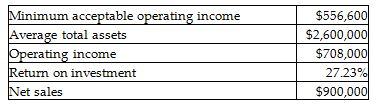

Barrera Corporation provides the following financial information:

Calculate the target rate of return. (Round your answer to two decimal places.)

A) 21.41%

B) 78.67%

C) 27.23%

D) 61.84%