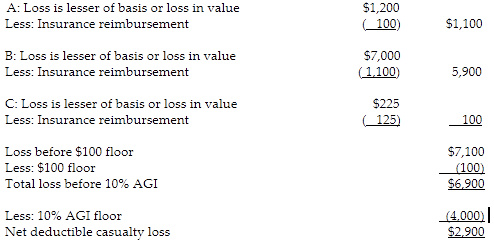

What is the amount of the net deductible casualty loss?

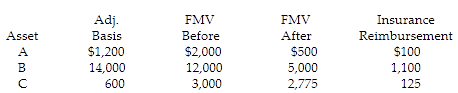

Determine the net deductible casualty loss on Schedule A for Alan Michael when his adjusted gross income was $40,000 in 2018 and the following occurred:

All casualty losses were nonbusiness personal-use property loss and occurred in a federally declared disaster area.

You might also like to view...

The difference between the par value and the price of a stock when the stock is issued at a price above par is known as a(n) ____________________

Fill in the blank(s) with correct word

The failure to obtain a license required by a statute for revenue-raising purposes:

A. automatically declares the contract void for the protection of the public. B. affects the legality of the unlicensed person's agreements and it will be considered void. C. does not affect the legality of unlicensed persons' agreements. D. results in generally unenforceable contracts.

While the majority of claims against companies come from unethical individuals, companies must still respond because of the few who believe they have a legitimate claim

Indicate whether the statement is true or false

______principles hold that human beings have certain fundamental rights and that a sense of duty to uphold these rights is the basis of ethical decision-making rather than a concern for consequences.

A. Consequences B. Deontological C. Cognitive morals D. Moral principle