A risk-neutral monopoly must set output before it knows the market price. There is a 50 percent chance the firm's demand curve will be P = 20 ? Q and a 50 percent chance it will be P = 40 ? Q. The marginal cost of the firm is MC = Q. What is the expression for the expected marginal revenue function?

A. E(MR) = 50 ? 2Q

B. E(MR) = 40 ? 2Q

C. E(MR) = 20 ? 2Q

D. E(MR) = 30 ? 2Q

Answer: D

You might also like to view...

In the case of a linear demand curve, average revenue is equal to price, while (with the exception of Q = 1 ) marginal revenue is less than price

Indicate whether the statement is true or false

Suppose that you are willing to pay $350 to see Leonard Cohen play at the Save-On-Foods Arena. Tickets cost $100, and the next-best alternative use of your time would be to work in paid employment earning $50 over the evening. The opportunity cost of seeing Leonard Cohen is equal to:

a. $100. b. $150. c. $200. d. $50.

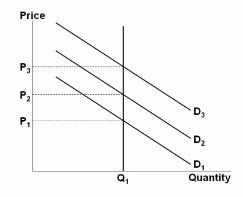

Refer to the figure. Assuming this market is representative of the economy as a whole, a negative demand shock will:

A. cause inflation.

B. increase unemployment.

C. lower prices but leave output unaffected.

D. reduce both prices and output.

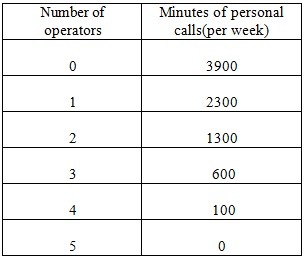

A government agency is having problems with personal telephone calls made during working hours. Because each minute of a personal call costs the agency $0.50 in wasted wages, it has decided to hire operators to monitor calls. The agency wants to hire the number of operators that will minimize the total cost of personal calls. Based on the above information, if operators receive $400 a week, what is the lowest possible total cost of personal calls?

Based on the above information, if operators receive $400 a week, what is the lowest possible total cost of personal calls?

A. $1450 B. $1500 C. $650 D. $800