Fannie Mae and Freddie Mac's rapid increase in the percentage of all mortgages held encouraged mortgage lenders to

a. tighten credit standards and decrease the number of sub-prime loans extended to borrowers.

b. offer lower rates than what Fannie Mae and Freddie Mac could offer.

c. lower credit standards and offer terms acceptable to Fannie Mae and Freddie Mac.

d. scrutinize the credit-worthiness of borrowers and require higher down payments on mortgages.

C

You might also like to view...

The policy irrelevance proposition implies that

A) anticipated monetary policy actions are effective in increasing real GDP, but they do not reduce unemployment. B) anticipated monetary policy actions are effective in stimulating aggregate supply, but they are not effective in stimulating aggregate demand. C) unanticipated monetary policy actions are equally effective in stimulating both aggregate demand and aggregate supply. D) anticipated monetary policy actions are ineffective in generating changes in real GDP.

If the labor force grows faster than the number employed, the

A. unemployment rate will fall. B. unemployment rate will rise. C. labor force rate will rise. D. employment rate will rise.

Refer to the figure above. What is the surplus enjoyed by the firm when it is the sole supplier of the medicine?

A) $30 B) $60 C) $90 D) $180

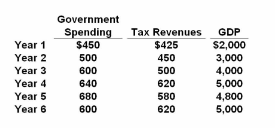

Refer to the data. If year 1 is the first year of this nation's existence and year 4 is the present year, the public debt as a percentage of GDP in year 4 is:

Answer the question using the following budget information for a hypothetical economy. Assume that all budget surpluses are used to pay down the public debt.

A. 7.5 percent.

B. 1.39 percent.

C. 2.5 percent.

D. 3.9 percent.