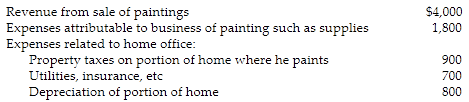

Dighi, an artist, uses a room in his home (250 square feet) as a studio exclusively to paint. The studio meets the requirements for a home office deduction. (Painting is considered his trade or business.) The following information appears in Dighi's records:

a. What is the amount of Dighi's home office deduction if he is self-employed?

b. If some amount is not allowed under the tax law, how is the disallowed amount treated?

c. Assume all of Dighi's records of expenses relating to the room were destroyed in a major paint spill. How much of a home office deduction, if any, will he be allowed?

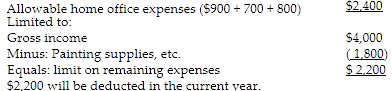

a.

b. The excess $200 ($2,400 allowable expenses - $2,200 net income ceiling on deduction) will carry over to next year.

c. The IRS now allows a safe harbor deduction of $5 per square foot. The allowable deduction will be $1,250 ($5 × 250 square feet).

You might also like to view...

A study by Duke University researchers who examined the records of nearly 12,000 university employees found that obese employees experienced medical costs that were more than __________ times higher than those of non-obese workers.

A. two B. three C. four D. five

Kurtulus Corporation uses the weighted-average method in its process costing system. Data concerning the first processing department for the most recent month are listed below: Beginning work in process inventory: Units in beginning work in process inventory 600 Materials costs$7,000 Conversion costs$2,300 Percent complete with respect to materials 55%Percent complete with respect to conversion 25%Units started into production during the month 6,500 Units transferred to the next department during the month 5,700 Materials costs added during the month$110,100 Conversion costs added during the month$83,200 Ending work in process inventory: Units in ending work in process inventory 1,400 Percent complete with respect to materials 70%Percent complete with

respect to conversion 55% The total cost transferred from the first processing department to the next processing department during the month is closest to: A. $193,300 B. $218,290 C. $202,600 D. $175,246

The capability to split a table into separate sections, often called ________, is possible with most relational database products

A) Partitioning B) Splitting C) Combining D) Normalizing

Adding new tables and relationships to a database is difficult

Indicate whether the statement is true or false