Jack purchases land which he plans on developing as a golf course. The land costs $20,000,000 and the cost of clearing the land, earthmoving, constructing hazards, bunkers and greens, and installing irrigation systems will cost an additional $6,000,000. What tax issues should Jack consider?

What will be an ideal response?

Are the costs of constructing the course considered depreciable land improvements or are they considered part of the cost of land, and not depreciable?

You might also like to view...

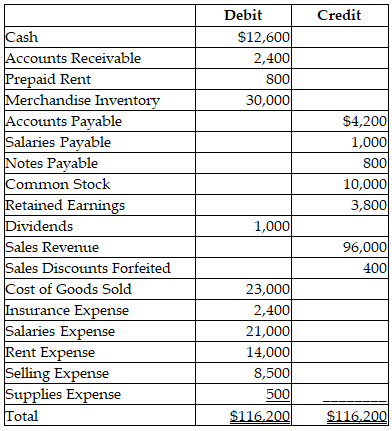

Prepare the journal entry to close the expense accounts. Omit explanation.

An adjusted trial balance for a merchandiser is given below.

In the context of using groups to improve decision making, unlike a-type conflicts, c-type conflicts:

A. disqualify the use of critics. B. often result in anger and resentment. C. can be created by using the devil's advocacy approach. D. involve the use of statements that focus on individuals.

What are the distinguishing features of a Chapter 13 plan? A) Each unsecured creditor must receive the same percentage of debt payments as the secured creditors

B) In exchange for a longer bankruptcy term the debtor may keep more personal assets. C) The debtor's assets are not liquidated, but disposable income is used to pay creditors for up to five years. D) Chapter 13 plans may be filed every year, as necessary.

Negligence of other parties is irrelevant to the imposition of liability in ______ cases

a. ultrahazardous activity b. limited liability c. misrepresentation d. fraud e. none of the other choices are correct