What is the difference between a deductible and a co payment as it applies to medical insurance?

What will be an ideal response?

A deductible is the amount that the insured pays before the insurance company begins paying. For example, a person may have a $250 deductible. This means that the insured pays the first $250 of health care expenditures before the insurance company begins paying. A copayment is the amount of cost-sharing between the insured and the insurance company. If the insurance company covers 80 percent of the cost of a medical treatment, then the insured has to copay 20 percent of that cost.

You might also like to view...

Although originally its articulation may have been a mistake, the rule of reason has become a useful principle for interpreting antitrust law

Indicate whether the statement is true or false

Rent controls often have adverse effects, including

A) too much housing in a community. B) deterioration in the quality of existing rental units. C) too much construction of new rental units in the community. D) income transfers from the poor to landlords.

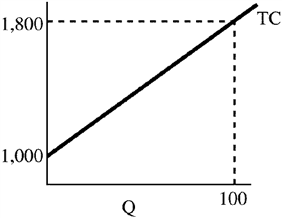

Figure 7-7

In Figure 7-7 at 100 units, AFC equals

a.

10.

b.

100.

c.

180.

d.

1,000.

There is a concern that carbon emissions that are a byproduct of the burning of coal and other fuels contributes to global warming. One proposed solution is to tax the use of these fuels based on their carbon content. The following table gives information on the demand and supply of coal: Price ($/ton)400 350 300 250 200 Quantity demanded 10 12 14 16 18 Quantity supplied 18 16 14 12 10 What will be the free-market price and quantity, and what will be the price and quantity if the government requires suppliers to pay a $100 tax for each ton of coal produced?

What will be an ideal response?